Kya aap apna debt nahi chuka paa rahe?

You are at the right place. With our help and your savings we will help you settle your debt.

Yeh hai asli Aazaadi

Resolve your Debts with

FREED’s Debt

Resolution Program

- Self save model

- Customized Plan

- Collection Harassment Support

(This is NOT a LOAN; you pay off the Debt with the

money you save in your SPA*Account)

6 steps to a debt-free zindagi

YOUR DASHBOARD: You get a login to track your debt-relief journey

1

How to handle

collection calls

2

What are the rights

of the lenders

3

What are your

rights

4

Respond to legal

notices and more

We are there to help, always!

Debt-Free by Dec 2027*

or sooner

Total Est. Savings

Debt Free In

Aapki Journey, Humara Saath

Aapke Sawaal, Humare Jawaab

- Collection Harassment Support

- App tools & Credit Insights

- On-call counsellor support

- Personalized dashboard

- Lender negotiation

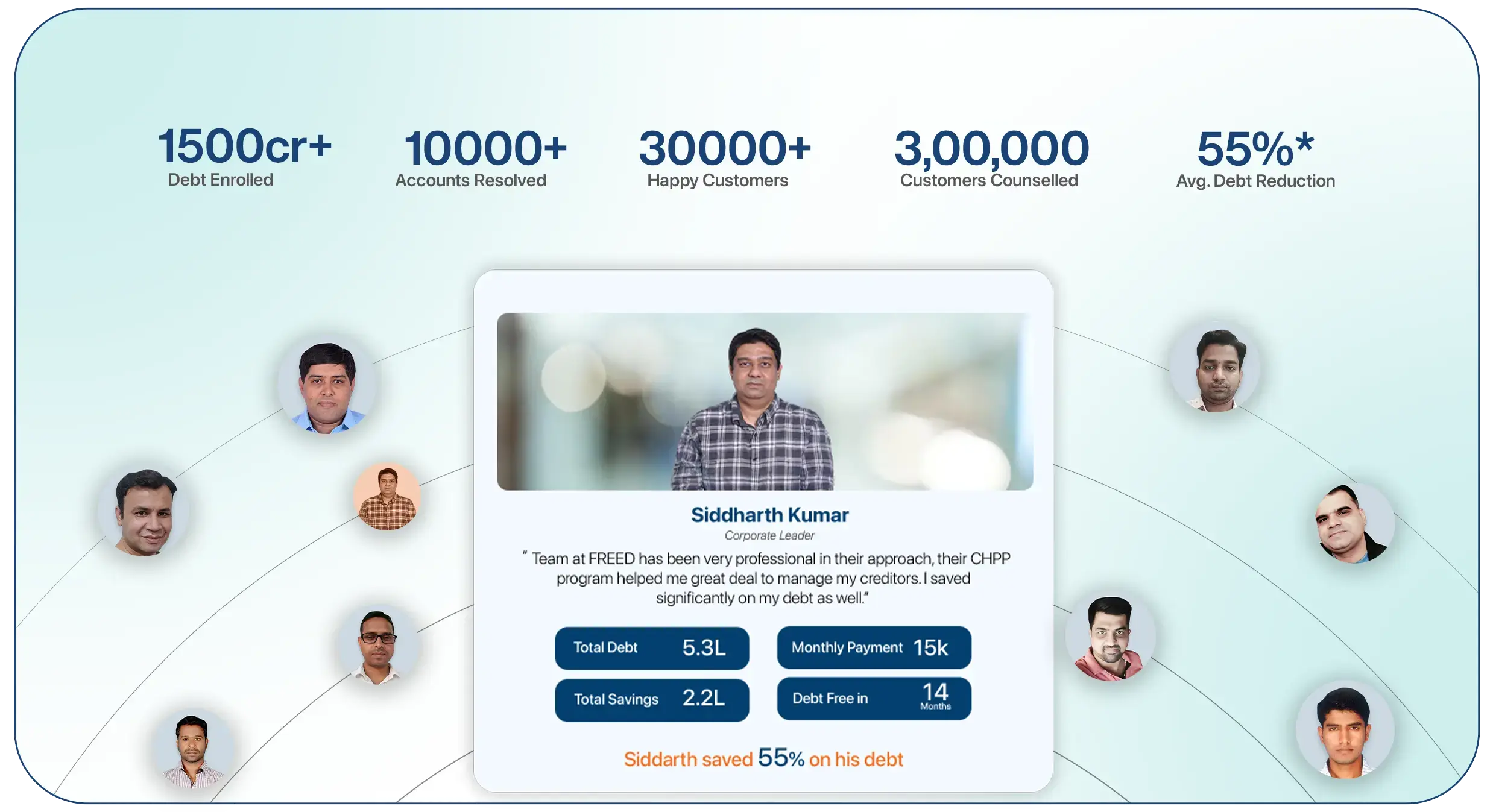

Disclaimer

*Please note that clients who are able to stay in the program and get their debts settled realize approximate savings of 50% before our fees and 35% including our fees. All claims are estimates and are based on the enrolled debts and the program tenure. Not all clients are able to complete their program for various reasons, including their ability to keep up with the program payments and save sufficient funds. Not all debts are eligible for enrollment in the Debt Resolution program. FREED doesn’t recommend enrollment in a Debt Resolution Program unless there is a genuine financial hardship experienced by a client leading to non-payment of dues.

There is no guarantee that your debts would be resolved within a specific period of time or they would be lowered by a specific amount or percentage. We do not assume your debts, make monthly payments to your creditors or provide tax, accounting or legal advice. Please read and understand all program details prior to enrollment. Enrolling in the Debt Resolution Program will have an adverse impact on your credit rating and may result in you being subjected to aggressive collection measures or even being sued by creditors. The accounts you enroll may continue to accrue fees and interest, however, negotiated settlements that we obtain on your behalf would resolve the entire account balance, including accrued fees and interest.